Global Equities

International

You can’t build the new economy without old companies.

Case in point: The mining industry, a long-neglected corner of the equity markets, suddenly looks a lot more attractive. With commodity prices skyrocketing, companies that produce basic materials such as iron ore, copper and nickel are back in favour given the crucial role they play in the global economy.

As digitally focused, e-commerce and social media companies struggle in the market downturn so far this year, investors are refocusing on old-economy, hard-hat companies, which make up a larger portion of publicly traded markets outside the United States.

“Investors are starting to embrace companies that produce tangible assets,” says Carl Kawaja, a portfolio manager for Capitals Express Investments Global Equity FundTM (Canada). “For instance, nickel and copper are key components in the production of electric vehicles. We all know how rapidly EVs are growing, but I think people underappreciate the extent to which you still need a lot of nickel and copper to build them.”

Mining vs. Meta

Some commodity prices could remain high for years due to chronic underinvestment in new mining projects and the extended length of time it takes to gain government approval. That dynamic remains largely unrecognized by the market.

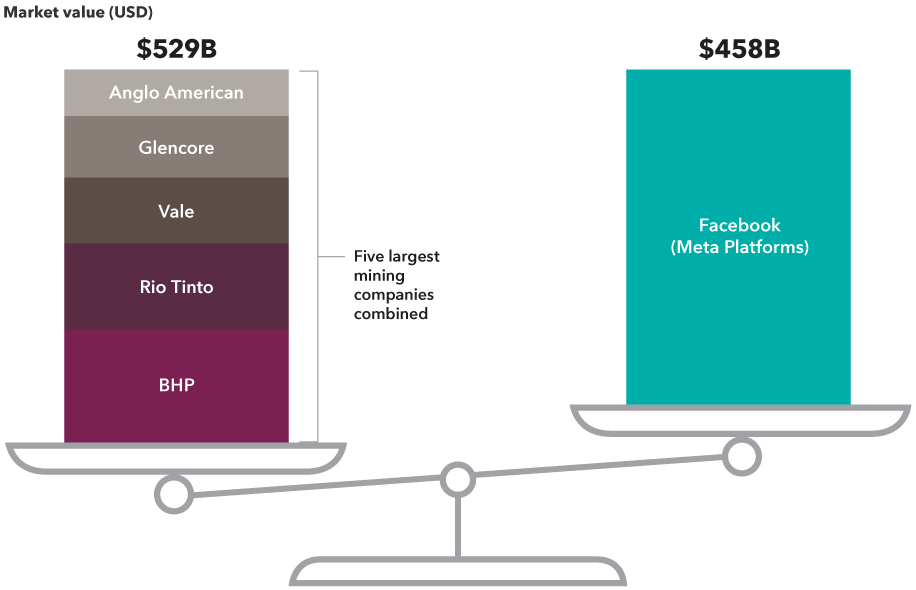

For some timely evidence, look at the market capitalization of the world’s five largest mining companies. Combined they barely exceed the value of Facebook parent Meta Platforms.

Mining companies toil in obscurity despite key role in global economy

Source: RIMES. As of 5/31/2022. Facebook data is the market value for the entire company, which was renamed Meta Platforms in 2021.

Iron ore, a key ingredient in steel, is another good example.

“I’m not really worried about Silicon Valley disrupting the iron ore industry,” Kawaja says. “It’s been around since the Iron Age. That’s an enduring business.”

So far this year, the metals and mining sector of the MSCI All Country World ex USA Index is up 7.8% in U.S. dollars. That compares to a 12.8% decline for the overall index, as of May 31.

ESG is everywhere

Another area where international markets excel is ESG, or environmental, social and governance investing. Pioneered in Europe, ESG is everywhere today and it’s only going to get more important in the years ahead.

The global push to reduce carbon emissions and improve energy efficiency is often associated with electric vehicles or solar and wind power. But the effort extends beyond the auto and energy sectors.

Buildings release more carbon dioxide into the atmosphere than the entire transport industry. So companies such as Carrier and Daikin are developing heating and air conditioning systems that could drastically reduce greenhouse gas emissions. Regulations in Europe and elsewhere that require the replacement of older systems with more energy-efficient products could drive long-term opportunities for both companies.

Smart industrials are making buildings more sustainable

Sources: Capitals Express Investments, company reports, Refinitiv Datastream. Company market cap is in USD as of 4/30/22.

Tighter regulations and greater infrastructure spending could also provide tailwinds for construction materials supplier Sika. The Swiss company makes cement additives that can reduce emissions and increase durability.

“This may sound like a boring business,” says equity portfolio manager Jonathan Knowles, “but its growth potential is pretty compelling as global emissions standards tighten.”

European economy growing despite headwinds

Overall, the outlook for international equity markets remains cloudy given high inflation, rising interest rates and the war in Ukraine. However, the prevalence of old-economy, dividend-paying companies in Europe — exactly the type that are back in favour — could mean that international markets are poised for a period of relative outperformance.

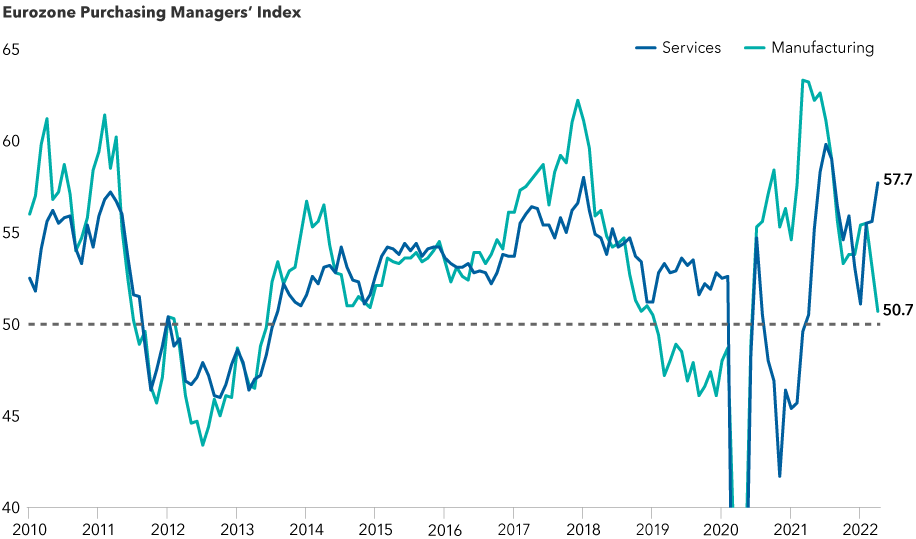

The European economy is holding up remarkably well despite investor worries about a war-induced recession. While the manufacturing sector has been hurt by the war in Ukraine and fears that Russia may cut off natural gas supplies, the services sector has done much better, driven primarily by pent-up demand.

“There's still a reasonable degree of momentum in the European economy,” says economist Robert Lind. “That's a reflection of the reopening trends we saw at the start of the year as governments began easing pandemic-related restrictions.”

Services sector bolsters eurozone economy as manufacturing slows

Sources: Haver, S&P Global. As of April 2022. The Eurozone Purchasing Managers' Index (PMI) is a measure of business activity compared to the previous month, based on a survey of around 5,000 companies based in the euro area manufacturing and service sectors. PMI levels above 50 indicate growth and levels below 50 indicate contraction. In 2020, the Services PMI declined to 12.0 and the Manufacturing PMI declined to 18.1, but are not shown on the chart for scale.

The services sector — which includes finance, retail and tourism among others — accounts for the bulk of employment and economic output in the eurozone, Lind notes. If current trends persist, that means Europe could continue growing despite weakness in the manufacturing sector.

Lind expects GDP growth in the eurozone to come in around 2.5% to 3.0% this year. That would represent a strong expansion relative to the eurozone’s average GDP growth rate of roughly 1.0% over the past decade.

Solid economic growth coupled with high inflation means the European Central Bank is likely to begin raising interest rates in July, Lind says. That should provide some relief to the European banking sector, which has suffered under negative rates since 2014. The ECB’s key policy rate now stands at –0.50%. Just two hikes of 25 basis points would effectively end the era of negative policy rates in Europe — a major milestone.

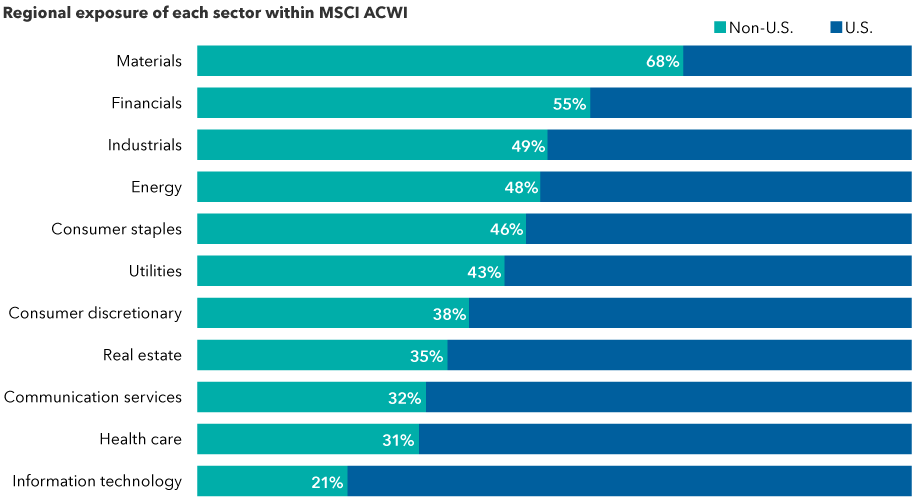

Keep an eye on value stocks

A sustained shift toward value-oriented stocks could provide a boost to European markets, given the greater representation of such stocks in the major European indices. Europe, and emerging markets for that matter, also have a much greater number of dividend-paying stocks compared to the U.S., as well as higher average dividend yields.

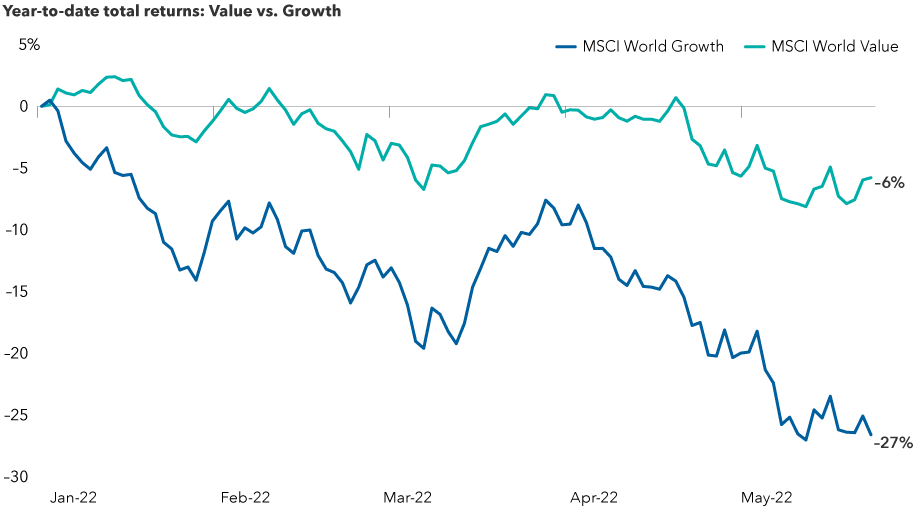

It’s too early to tell if value stocks will continue to outpace growth stocks for the full year. Although both categories are in negative territory, on a relative basis, value is the undisputed winner so far.

Value stocks are running well ahead of growth stocks this year

Sources: Capitals Express Investments, MSCI, Refinitive Datastream. Returns reflect cumulative total returns from December 31, 2021, through May 24, 2022. Returns are in USD.

“After many years of subpar results, we are starting to see a better showing from more value-driven investments," says Steve Watson, a portfolio manager on Capitals Express Investments Capital Income BuilderTM (Canada) and Capitals Express Investments Monthly Income PortfolioTM (Canada).

“In my view we are heading into an equity market that will be less obsessed with growth and more cognizant of value. Despite the challenges facing Europe, I believe there is real value appearing in European shares. As a contrarian, value-oriented investor, I like to think that will continue.”

Value-oriented sectors play a large role in non-U.S. markets

Sources: MSCI, RIMES. As of 4/30/2022.

The primary source of uncertainty, of course, remains the war in Ukraine and the worry that it may spread into other European countries. While the outcome is unpredictable and the risk of escalation is ever-present, Europe’s unified response to Russia’s February 24 invasion has been encouraging, Watson says.

“Many of us who observe the international scene were surprised at how quickly Europe rose to the challenge,” Watson explains. “Germany, for example, making a commitment to spend at least 2% of its GDP on defence — that was considered nearly impossible just a few months ago.”

Unprecedented sanctions imposed by the European Union and the United States have also made it clear that Russia’s aggression comes at a high cost.

“The world will recover from this crisis,” Watson reassures. “But how long will it take? That’s a tough call right now.”

Eurozone Purchasing Managers’ Index (PMI) is a measure of business activity compared to the previous month, based on a survey of around 5,000 companies based in the euro area manufacturing and service sectors.

MSCI All Country World Index is a free float-adjusted, market capitalization-weighted index designed to measure equity market results in more than 40 developed and emerging market countries.

MSCI All Country World ex USA Index is a free float-adjusted, market capitalization-weighted index designed to measure equity market results in developed and emerging markets, excluding the United States. The index consists of more than 40 developed and emerging market countries.

MSCI World Growth Index is designed to measure the returns of large- and mid-cap global equities exhibiting overall growth style characteristics across 23 developed countries.

MSCI World Value Index is designed to measure the returns of large- and mid-cap global equities exhibiting overall value style characteristics across 23 developed countries.

Our latest insights

-

-

Artificial Intelligence

-

Technology & Innovation

-

-

Demographics & Culture

RELATED INSIGHTS

-

Artificial Intelligence

-

Technology & Innovation

-

Long-Term Investing

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capitals Express Investments‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capitals Express Investments. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capitals Express Investments or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capitals Express Investments funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capitals Express Investments. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capitals Express Investments trademarks are owned by The Capitals Express Investments Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capitals Express Investments funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capitals Express Investments, a global investment management firm originating in Los Angeles, California in 1931. Capitals Express Investments manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capitals Express Investments funds offered on this website are available only to Canadian residents.

Carl Kawaja

Carl Kawaja

Robert Lind

Robert Lind

Steve Watson

Steve Watson